A well-designed invoice record keeping template is crucial for any business, regardless of its size or industry. It serves as a comprehensive system for tracking all financial transactions, ensuring accurate accounting, and maintaining a professional image. This guide will delve into the key elements that contribute to a professional and effective invoice record keeping template.

Clarity and Conciseness

The template should prioritize clarity and conciseness to avoid confusion and errors.

Utilize clear and concise language throughout the template. Avoid jargon and technical terms that may be unfamiliar to clients.

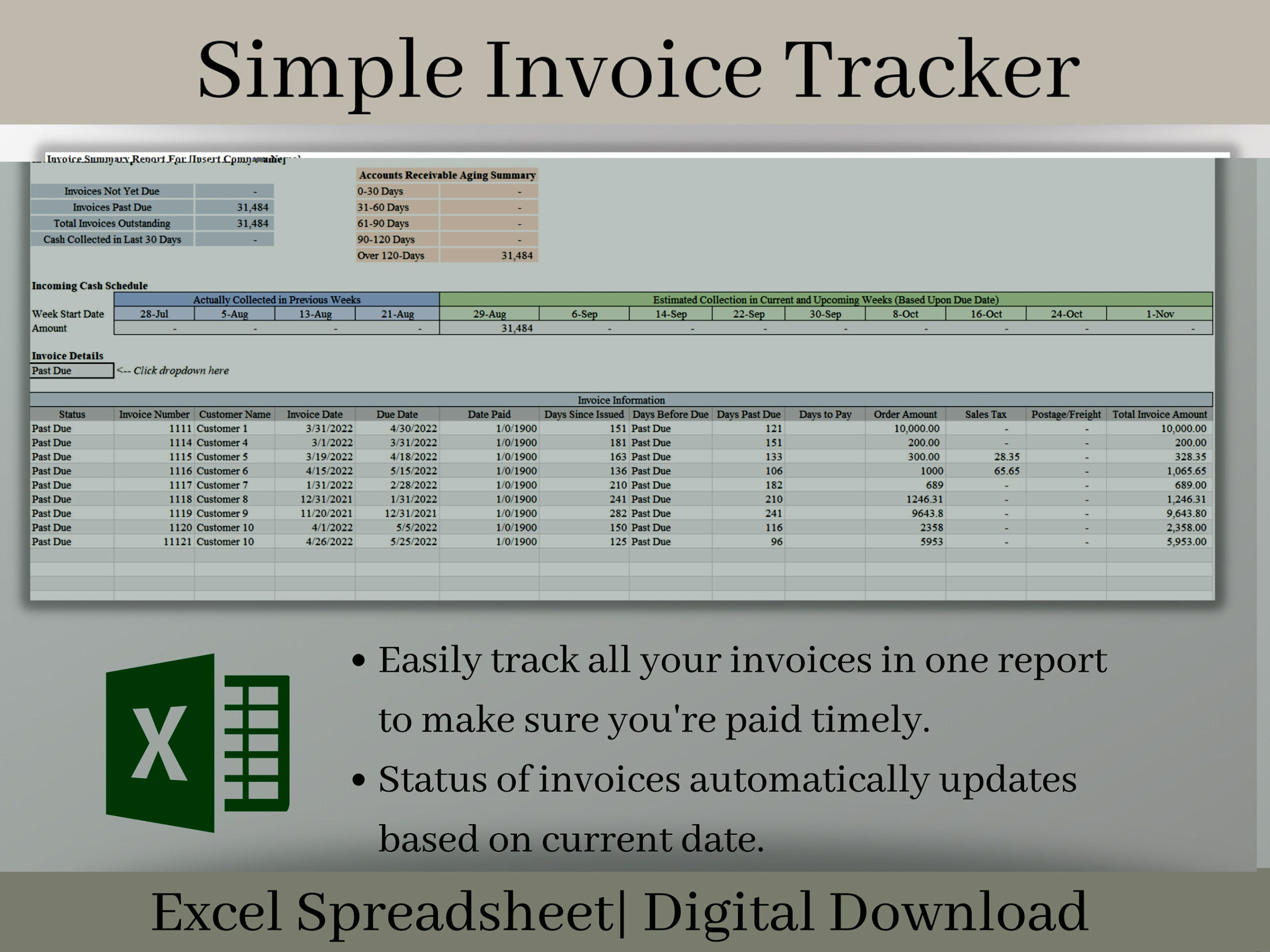

Professional Aesthetics

Image Source: everyexcel.com

The visual presentation of the invoice record keeping template plays a significant role in conveying professionalism and building trust with clients.

Choose a professional and visually appealing color scheme that reflects your brand identity. Avoid overly bright or distracting colors.

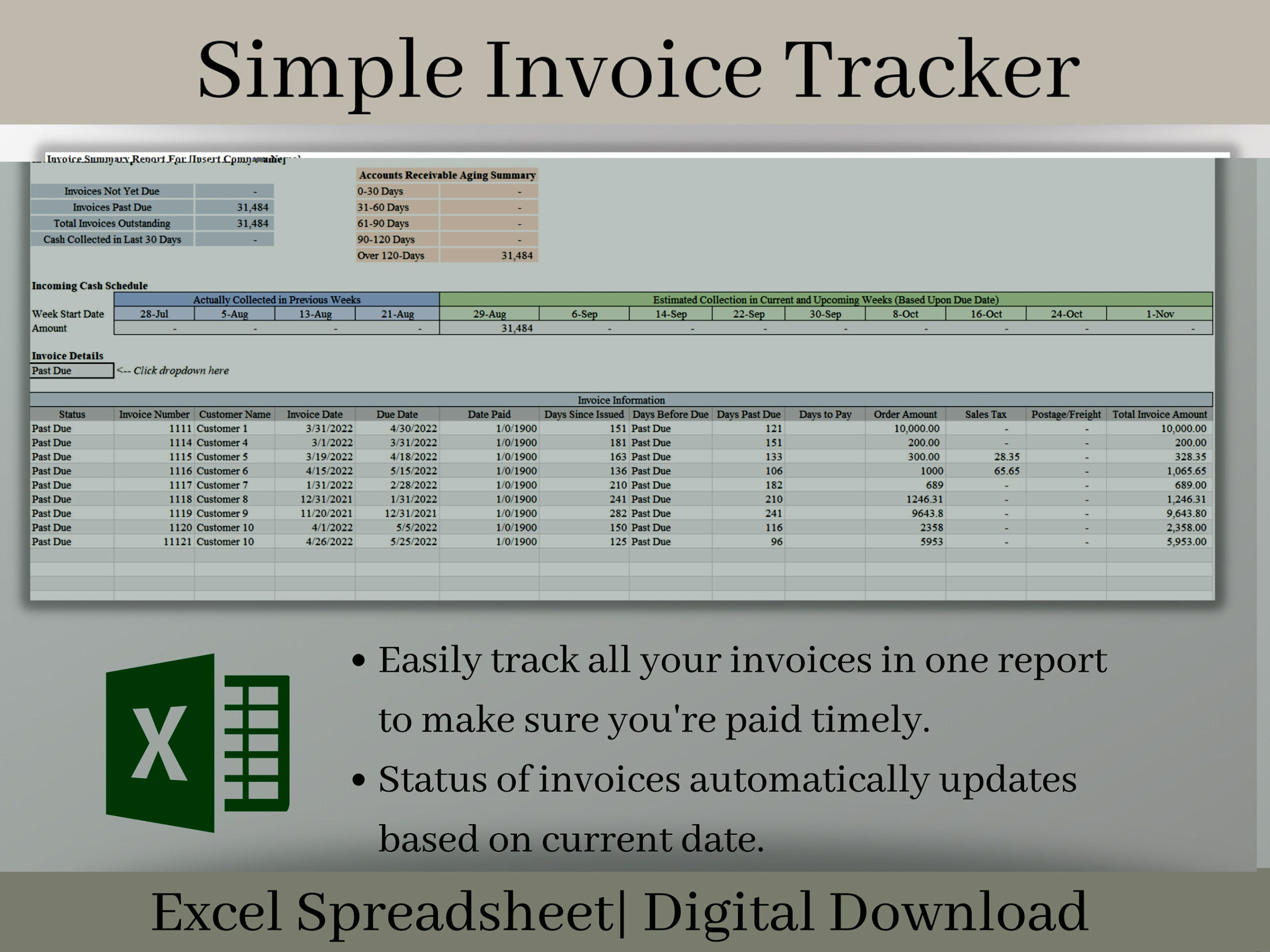

Essential Information

The template must include all the essential information required for accurate invoicing and record-keeping.

Image Source: everyexcel.com

Invoice Number: A unique identifier for each invoice, facilitating easy tracking and reference.

Customization

A flexible template that can be easily customized to suit specific business needs is highly valuable.

Include fields for optional information, such as purchase order numbers or project names, to cater to different client requirements.

Data Security

Protecting sensitive client data is paramount.

Implement appropriate security measures to safeguard client information, such as password protection and encryption.

User-Friendliness

The template should be user-friendly and easy to navigate for both the business owner and the client.

Employ a clear and intuitive layout that makes it easy to locate and understand information.

Regular Review and Updates

Regularly review and update the template to ensure its accuracy, relevance, and compliance with the latest industry standards and legal requirements.

Stay informed about changes in tax laws, accounting regulations, and data privacy regulations.

By incorporating these elements, businesses can create professional and effective invoice record keeping templates that streamline their financial processes, enhance their professional image, and foster strong client relationships.