A Promise to Pay Agreement is a legally binding document that outlines a debtor’s commitment to repay a creditor a specific sum of money. It’s a crucial tool for businesses and individuals to formalize debt repayment plans. A well-crafted template ensures clarity, legal enforceability, and professional communication.

Key Elements of a Promise to Pay Agreement

A comprehensive Promise to Pay Agreement should include the following essential elements:

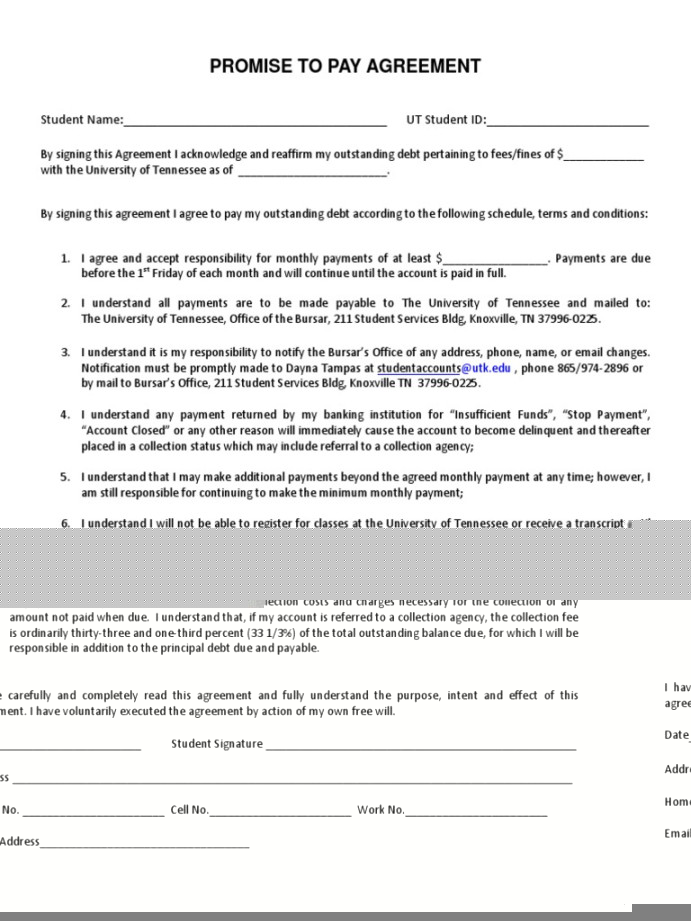

1. Parties Involved

Image Source: scribdassets.com

Debtor: Clearly identify the individual or entity owing the debt.

2. Debt Acknowledgment

Debt Amount: State the exact amount of the debt, including any accrued interest or fees.

3. Repayment Schedule

Payment Amount: Specify the amount of each payment.

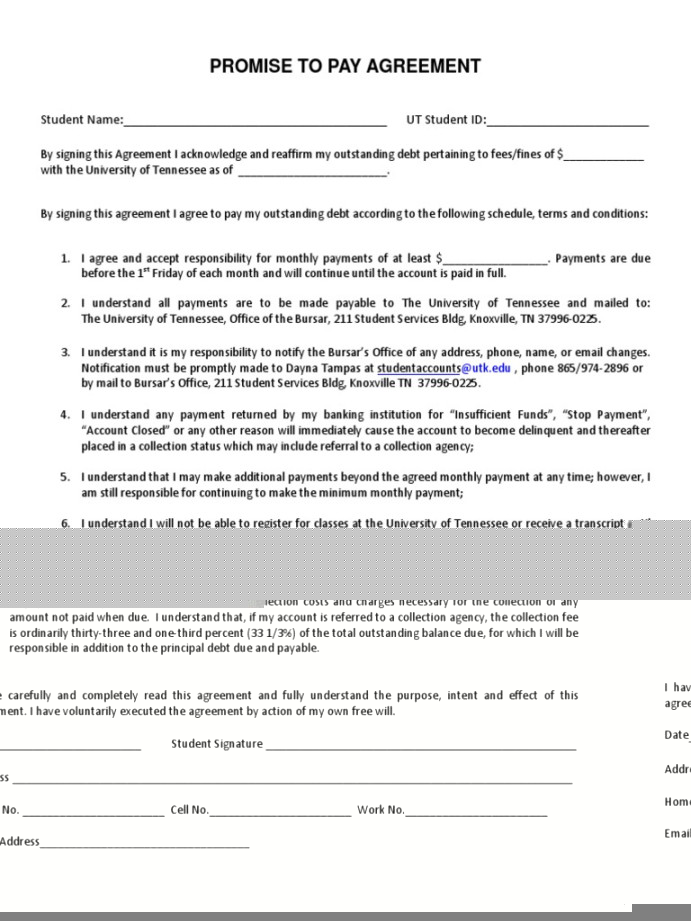

4. Payment Methods

Image Source: scribdassets.com

Accepted Payment Methods: Clearly state the acceptable payment methods (e.g., check, money order, electronic transfer).

5. Default and Remedies

Default: Define what constitutes a default (e.g., missed payments, failure to comply with terms).

6. Governing Law and Dispute Resolution

Governing Law: Specify the jurisdiction whose laws govern the agreement.

Design Considerations for a Professional Template

To create a professional and trustworthy Promise to Pay Agreement template, consider the following design elements:

1. Clear and Concise Language

Plain Language: Use clear and concise language, avoiding legal jargon that may confuse the reader.

2. Consistent Formatting

Font: Choose a professional and easy-to-read font, such as Times New Roman or Arial.

3. Professional Layout

Margins: Use standard margins to ensure readability.

4. Legal Disclaimer (Optional)

WordPress Format Considerations

When creating a Promise to Pay Agreement template in WordPress, consider the following:

Template Hierarchy: Choose the appropriate template file (e.g., page.php, single.php) to ensure correct display.

By carefully considering these elements, you can create a professional and effective Promise to Pay Agreement template that protects your interests and fosters positive relationships with your debtors.