A Commercial Mortgage Broker Fee Agreement Template is a crucial legal document that outlines the terms and conditions between a commercial mortgage broker and a client. This agreement clearly defines the services provided by the broker, the fees charged, and the responsibilities of both parties. A well-drafted agreement ensures transparency, accountability, and legal protection for both the broker and the client.

Key Elements of a Commercial Mortgage Broker Fee Agreement Template

1. Parties Involved

- Broker: Clearly identify the broker’s legal name, business address, and contact information.

- Client: Specify the client’s legal name, business address, and contact information.

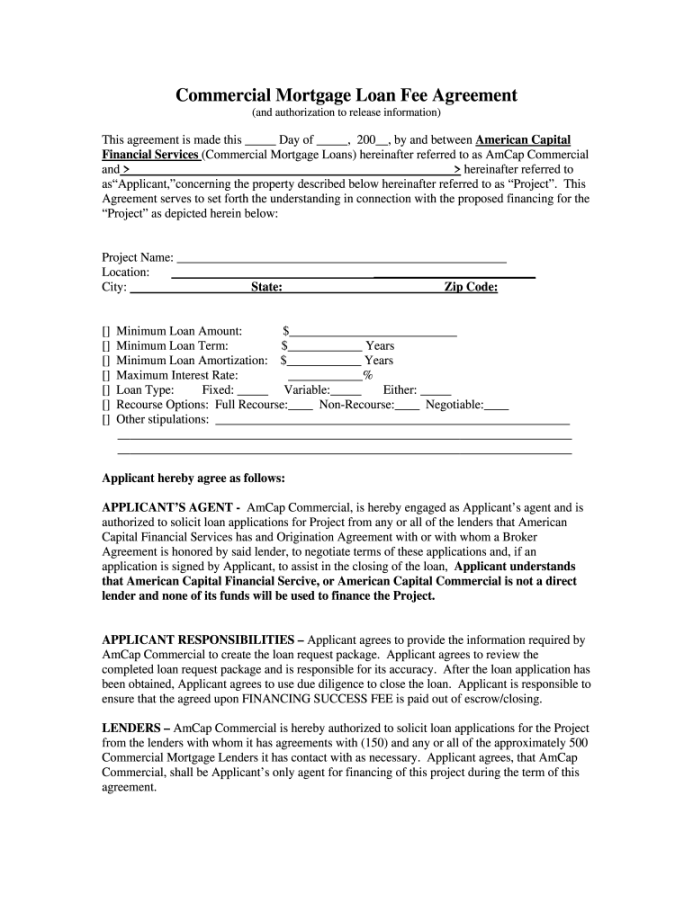

Image Source: pdffiller.com

2. Services Provided

- Core Services:

- Property Evaluation: Detail the broker’s role in assessing the property’s value and suitability for financing.

- Loan Origination: Outline the broker’s responsibility in identifying potential lenders and structuring the loan.

- Underwriting Assistance: Describe the broker’s support in preparing loan applications and documentation.

- Negotiation: Explain the broker’s role in negotiating favorable terms with lenders.

- Closing Coordination: Detail the broker’s involvement in coordinating the closing process.

Additional Services (Optional):

- Property Management: If applicable, specify any property management services provided by the broker.

- Consulting Services: If applicable, detail any consulting services offered, such as financial analysis or strategic advice.

3. Fees and Compensation

- Broker’s Fee: Clearly state the broker’s fee structure, whether it’s a flat fee, a percentage of the loan amount, or a combination of both.

- Fee Payment Schedule: Specify the payment terms, including any upfront fees, progress payments, or final payment upon loan closing.

- Reimbursement of Expenses: Outline any expenses that the client may be responsible for reimbursing, such as appraisal fees, title search fees, or other related costs.

4. Client Responsibilities

- Information Provision: The client must provide accurate and complete information to the broker, including financial statements, property documents, and other relevant materials.

- Cooperation: The client must cooperate with the broker and promptly respond to requests for information or documentation.

- Decision-Making: The client must make timely decisions regarding loan terms, lender selection, and other critical matters.

5. Broker’s Responsibilities

- Diligence: The broker must act diligently and professionally in representing the client’s interests.

- Confidentiality: The broker must maintain the confidentiality of the client’s information.

- Compliance: The broker must comply with all applicable laws, regulations, and industry standards.

6. Term and Termination

- Term: Specify the duration of the agreement, whether it’s a fixed term or a term that continues until the loan closes.

- Termination: Outline the conditions under which either party may terminate the agreement, such as breach of contract or mutual agreement.

7. Governing Law and Dispute Resolution

- Governing Law: Specify the jurisdiction whose laws will govern the agreement.

- Dispute Resolution: Outline the preferred method for resolving disputes, such as mediation, arbitration, or litigation.

8. Entire Agreement and Modifications

- Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior agreements or representations.

- Modifications: Specify the process for modifying the agreement, including any required written consent.

Design Elements for a Professional Template

Clean and Professional Layout: Use a clean and professional layout with clear headings and subheadings.

- Consistent Formatting: Maintain consistent formatting throughout the document, including font size, font style, and line spacing.

- Professional Typography: Choose a professional and easy-to-read font, such as Times New Roman or Arial.

- Clear and Concise Language: Use clear and concise language to avoid ambiguity and legal jargon.

- Professional Logo: Include your company’s logo at the top of the document.

- Page Numbering: Add page numbers to the bottom of each page.

By incorporating these elements, you can create a professional and effective Commercial Mortgage Broker Fee Agreement Template that protects your interests and builds trust with your clients.