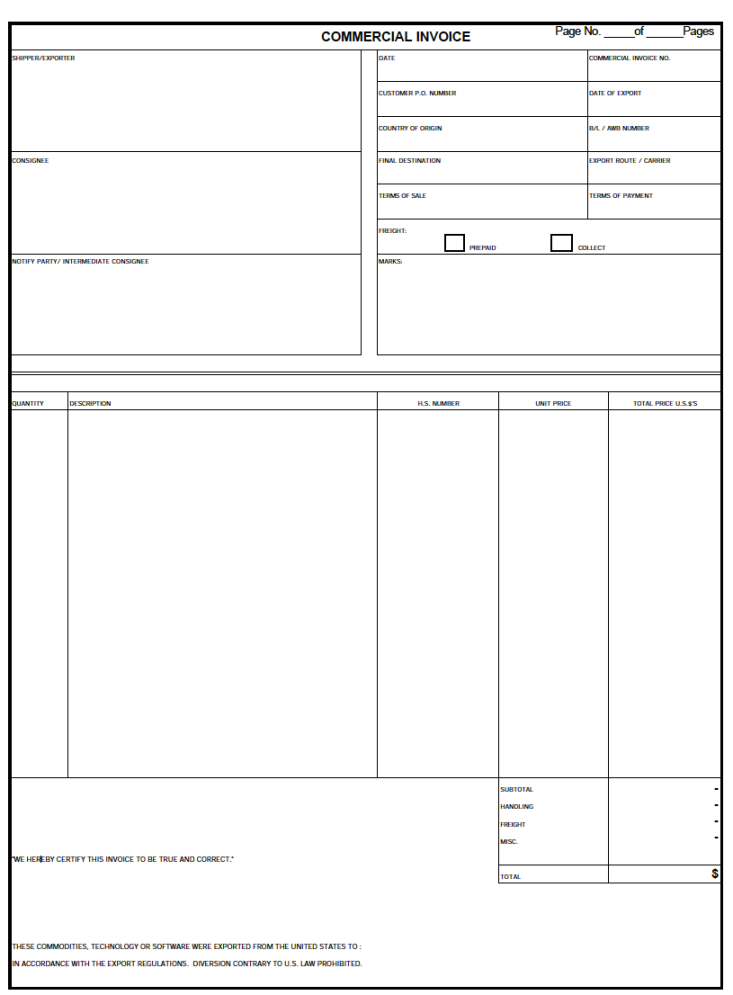

A Customs Commercial invoice is a crucial document in international trade, serving as a primary source of information for customs authorities worldwide. This document provides detailed information about the goods being exported or imported, including the shipper, consignee, product description, quantity, value, and other relevant particulars. A well-designed and professional Customs Commercial Invoice template is essential for smooth customs clearance, minimizing delays and potential disputes.

Essential Elements for a Professional Template

A professional Customs Commercial Invoice template should encompass all the necessary information required by customs authorities. These elements typically include:

1. Invoice Number and Date

Image Source: opendocs.com

The invoice should be uniquely numbered and clearly dated to facilitate tracking and record-keeping.

2. Seller/Exporter Information

Complete and accurate information about the seller or exporter is crucial. This includes the company name, registered address, contact details (phone, email, website), and relevant tax registration numbers.

3. Buyer/Importer Information

Similar to the seller information, the buyer or importer’s details are essential. Include the company name, registered address, contact information, and any relevant import licenses or permits.

4. Shipping Information

Detailed shipping information is paramount. This includes:

5. Product Description

The product description is the most critical section of the invoice. It must be detailed and accurate to ensure proper customs classification and valuation.

6. Value and Currency

Accurate valuation is essential for customs duties and taxes.

7. Terms of Payment

Clearly state the agreed-upon terms of payment, such as:

8. Insurance

Indicate whether the goods are insured and, if so, provide details of the insurance policy.

9. Declarations and Certifications

Include any necessary declarations and certifications, such as:

10. Authorized Signatories

The invoice must be signed and dated by authorized representatives of both the seller and the buyer.

Design Considerations for a Professional Template

The visual presentation of the Customs Commercial Invoice is crucial for conveying professionalism and enhancing readability.

11. Layout and Formatting

A clean and organized layout enhances readability. Consider using:

12. Professional Logo

Incorporate the company logo of both the seller and the buyer to add a professional touch and enhance brand recognition.

13. Watermark

Consider adding a subtle watermark to the document, such as the company name or “Original” to deter counterfeiting.

14. Security Features

Implement basic security features to enhance the authenticity of the document, such as:

15. Digital Signatures

Integrate digital signatures to ensure the authenticity and integrity of the document.

Conclusion

A well-designed Customs Commercial Invoice template is crucial for efficient and hassle-free international trade. By incorporating the essential elements and design considerations outlined above, businesses can create professional and reliable invoices that meet the requirements of customs authorities worldwide.