Debt agreement templates are essential tools for individuals and businesses to effectively manage and resolve debt obligations. These pre-formatted documents outline the terms and conditions of a debt repayment plan between a debtor and a creditor. A well-crafted template ensures clarity, legal soundness, and a smooth debt resolution process.

Clarity and Conciseness

The cornerstone of any professional debt agreement template lies in its clarity and conciseness. Utilize plain and straightforward language, avoiding complex legal jargon that may confuse or intimidate the parties involved. Employ bullet points and numbered lists to break down complex information into easily digestible segments. Ensure that all terms and conditions are explicitly stated, leaving no room for ambiguity or misinterpretation.

Professional Formatting

Maintaining a professional and consistent format throughout the template is crucial. Utilize a clean and easy-to-read font such as Arial, Times New Roman, or Calibri. Maintain consistent font sizes and styles throughout the document, ensuring readability and visual appeal. Employ appropriate headings and subheadings to structure the agreement logically and enhance navigation. Utilize white space effectively to improve readability and create a visually appealing document.

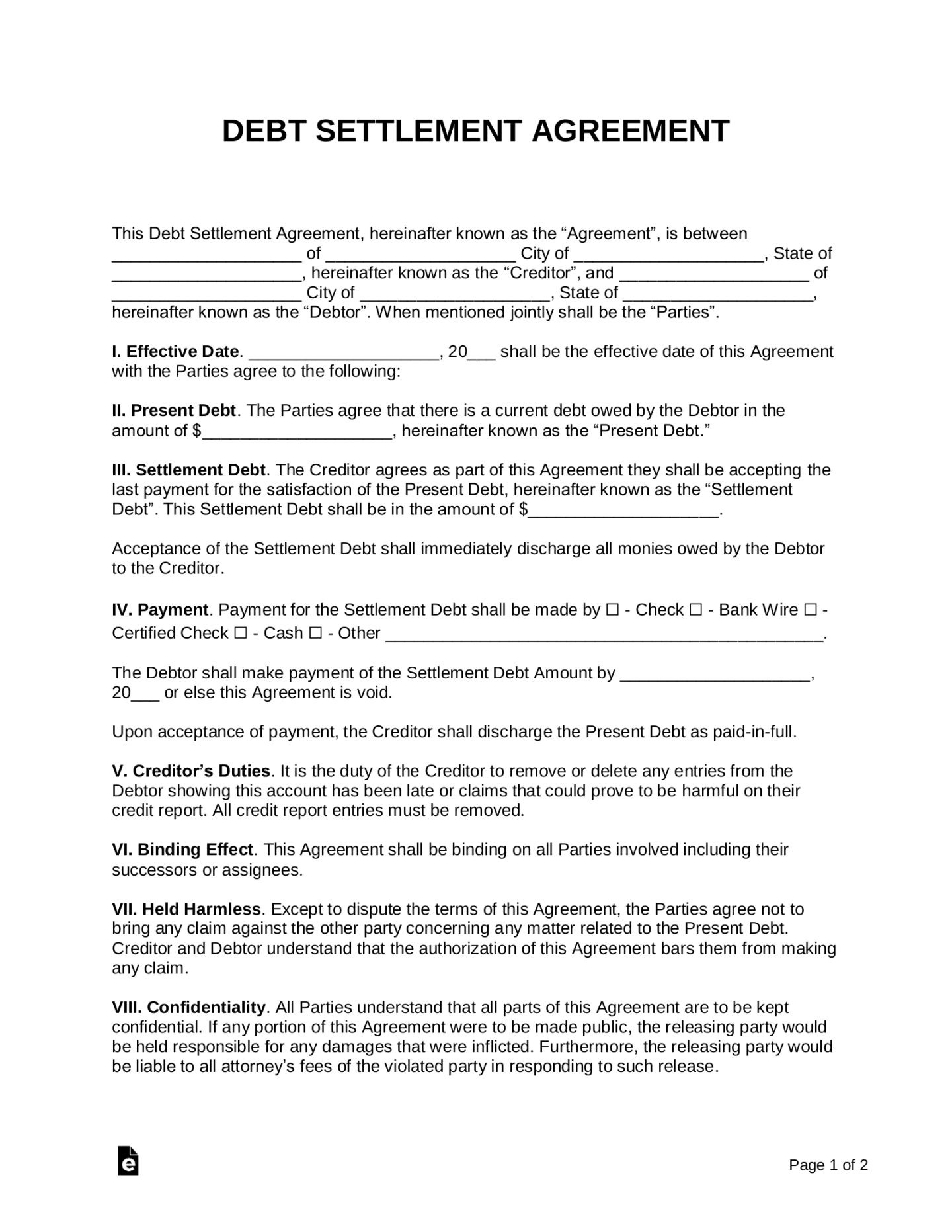

Legal and Ethical Considerations

Image Source: eforms.com

Adhering to all applicable legal and ethical guidelines is paramount when drafting debt agreement templates. Ensure the template complies with relevant state and federal laws, including consumer protection laws and fair debt collection practices. Incorporate clauses that protect the rights of both the debtor and the creditor. Consider consulting with legal professionals to ensure the template’s accuracy and compliance with all relevant regulations.

Customization and Flexibility

While a template provides a standardized framework, it is essential to allow for customization to accommodate specific circumstances. Include fields and sections that can be easily modified to suit individual debt situations. Consider creating different versions of the template for various types of debt, such as consumer debt, business debt, or medical debt. Ensure the template is flexible enough to adapt to changing circumstances and accommodate unforeseen events.

Security and Confidentiality

Protecting sensitive information is crucial when dealing with debt agreements. Implement security measures to safeguard confidential data, such as social security numbers, bank account information, and financial records. Ensure the template and related documents are stored securely and accessed only by authorized personnel. Consider utilizing encryption and password protection to enhance the security of sensitive information.

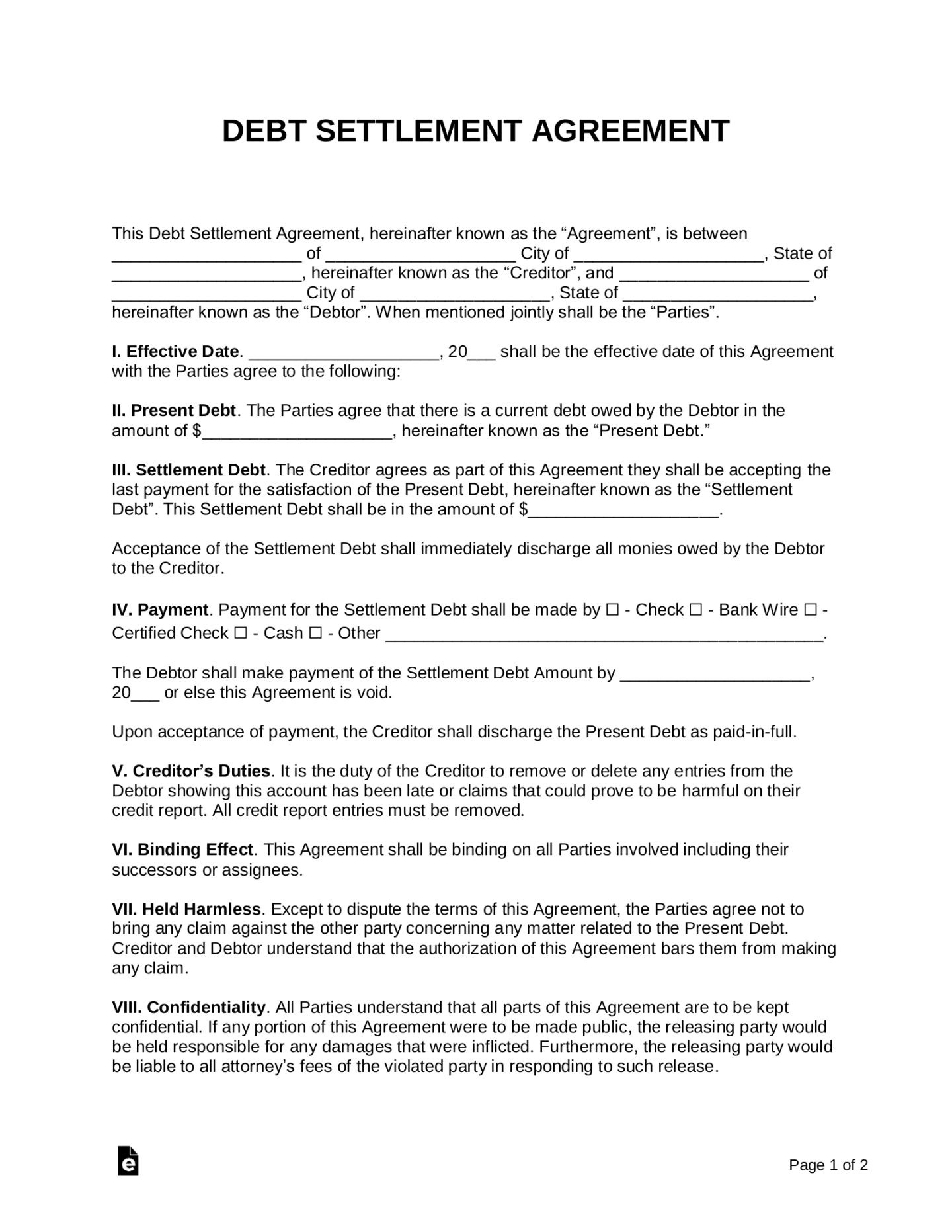

Accessibility and User-Friendliness

Image Source: eforms.com

Design the template with user-friendliness in mind. Ensure the document is easily accessible and navigable, with clear instructions and guidance for both debtors and creditors. Consider providing online or downloadable versions of the template to enhance accessibility. Utilize a user-friendly interface that allows for easy customization and completion of the agreement.

Professional Design Elements

Incorporate professional design elements to enhance the credibility and trustworthiness of the debt agreement template. Utilize a professional logo or letterhead to establish a strong brand identity. Employ a color scheme that conveys professionalism and trustworthiness, such as blue, green, or gray. Incorporate a clean and modern layout that is visually appealing and easy to navigate.

Conclusion

By carefully considering these factors, you can create professional and effective debt agreement templates that serve the needs of both debtors and creditors. A well-crafted template fosters trust, facilitates clear communication, and ensures a smooth and successful debt resolution process.

Remember, this is just a basic framework. You can further enhance your templates by incorporating advanced features such as electronic signatures, automated payment reminders, and integration with accounting software. By continuously refining and improving your templates, you can streamline the debt resolution process and build strong relationships with both debtors and creditors.