A family loan agreement template is a crucial document that outlines the terms and conditions of a loan between family members. While lending and borrowing money within a family can often seem informal, having a well-defined agreement in place can prevent misunderstandings and potential conflicts in the future. This template serves as a legally binding contract that protects both the lender and the borrower.

Core Elements of a Family Loan Agreement

The template should encompass the following essential elements:

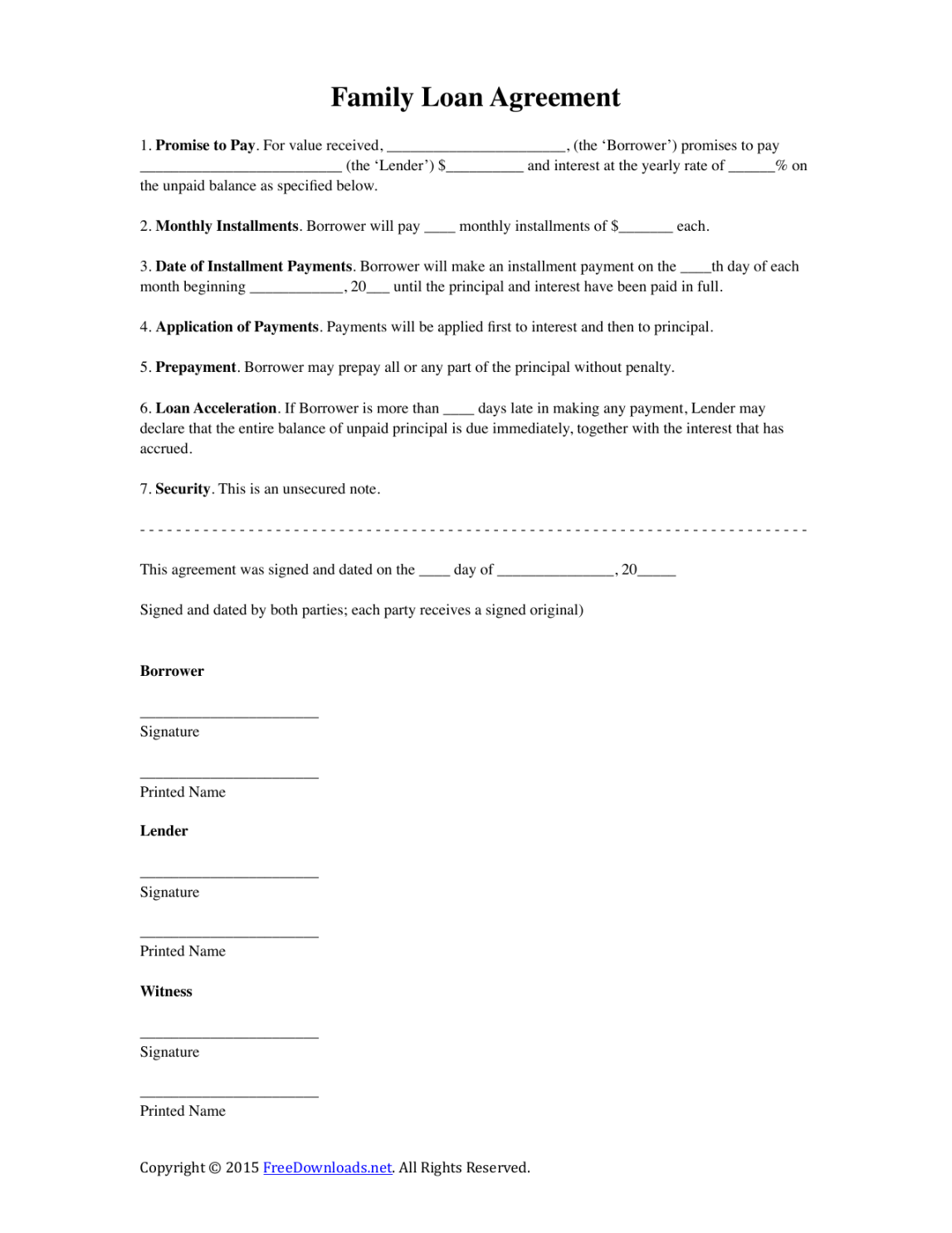

Loan Amount and Purpose

Image Source: freedownloads.net

Clearly state the exact loan amount in words and figures. Specify the intended use of the funds. This clarity helps prevent any ambiguity regarding the loan’s purpose and ensures that the borrower uses the money as agreed.

Interest Rate

Determine the interest rate applicable to the loan. This rate can be market-based, fixed, or variable. If interest is charged, clearly state the calculation method and frequency of compounding.

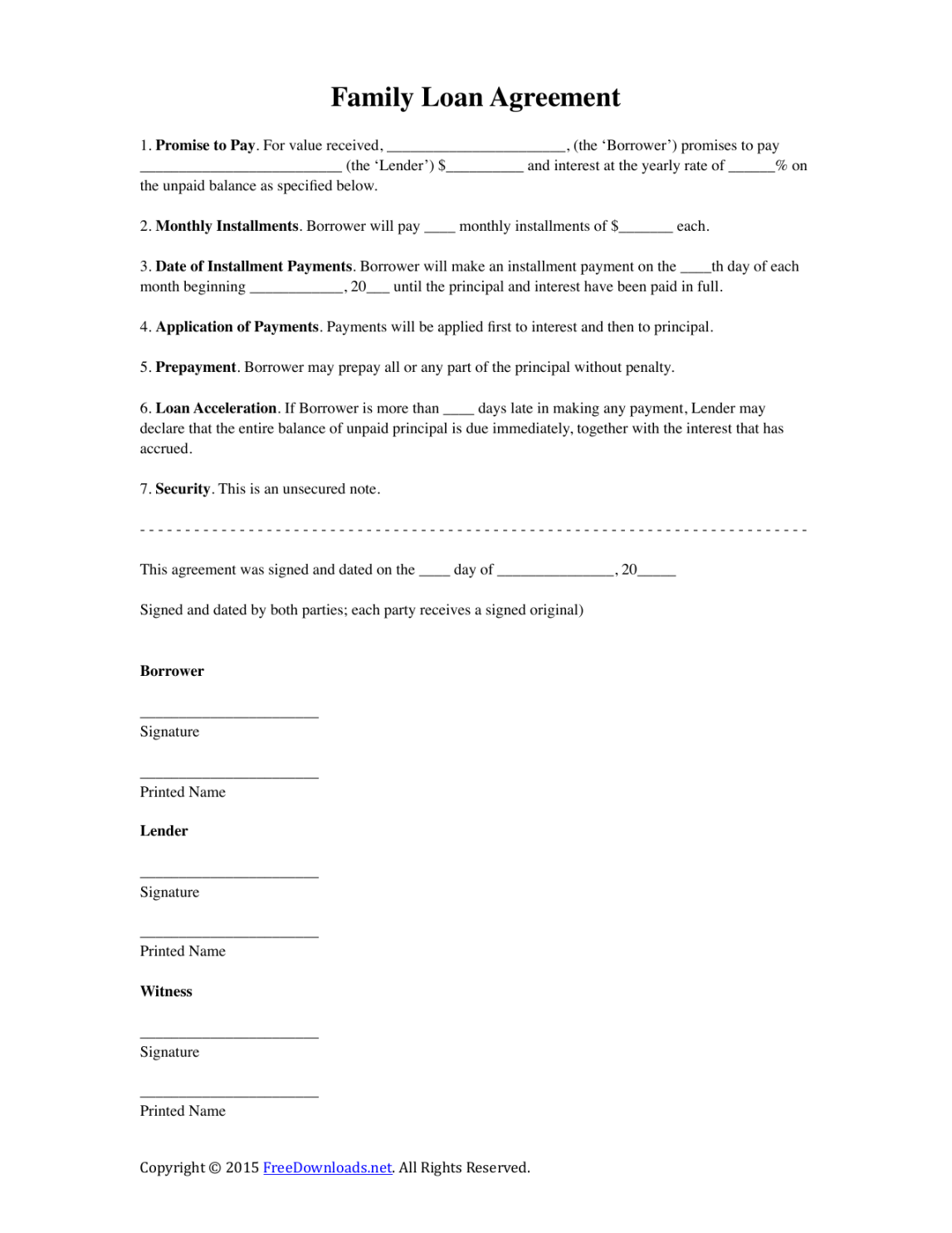

Repayment Schedule

Establish a clear and realistic repayment schedule. This should include:

Image Source: freedownloads.net

Repayment Frequency: Determine whether repayments will be made weekly, bi-weekly, monthly, quarterly, or annually.

Collateral (Optional)

If collateral is involved, describe it in detail. This could include property, vehicles, or valuable assets. Ensure that the collateral is adequately insured.

Default and Consequences

Define what constitutes a default on the loan. This may include missed payments, failure to meet other agreed-upon terms, or bankruptcy. Outline the consequences of default, such as acceleration of the loan balance, legal action, or repossession of collateral.

Dispute Resolution

Include a clause outlining the process for resolving any disputes that may arise. This could involve mediation, arbitration, or legal action.

Governing Law

Specify the jurisdiction and laws that govern the loan agreement.

Entire Agreement

Include a clause stating that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

Severability

Include a severability clause that states that if any provision of the agreement is deemed invalid or unenforceable, the remaining provisions shall remain in full force and effect.

Signatures

Ensure that all parties involved sign and date the agreement.

Design Considerations for a Professional Template

While the content is paramount, the design of the template significantly impacts its professionalism and readability:

Font and Formatting

Choose a professional and easy-to-read font: Arial, Times New Roman, or Calibri are suitable options.

Layout and Spacing

Use ample white space: This improves readability and makes the document appear less cluttered.

Professionalism and Trust

Maintain a formal and professional tone: Avoid colloquialisms or overly casual language.

Finding Free Family Loan Agreement Templates

Numerous resources are available online that offer free family loan agreement templates.

Legal websites and resources: Many legal websites and resources provide free downloadable templates.

Disclaimer

This guide provides general information about family loan agreements and is not intended as legal advice. It is essential to consult with an attorney to ensure that the agreement complies with applicable laws and meets your specific needs.

By following these guidelines and utilizing available resources, you can create a professional and legally sound family loan agreement template that protects the interests of all parties involved.