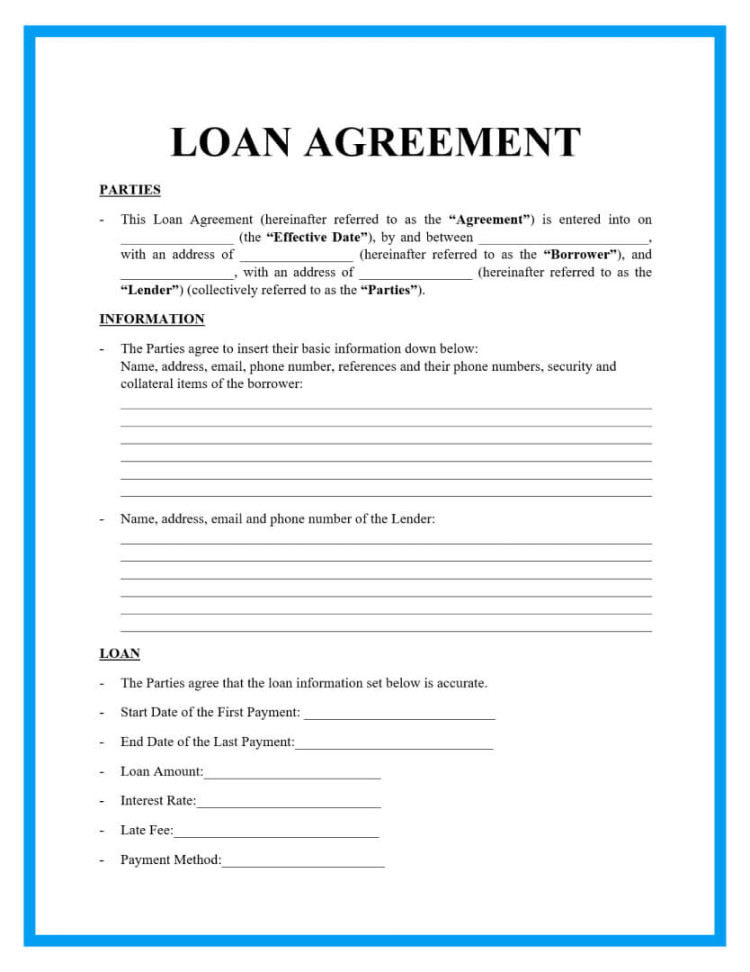

A blank Loan Agreement Template is a standardized document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as a legally binding contract that protects the interests of both parties.

Key Elements of a Comprehensive Blank Loan Agreement Template

Loan Amount and Repayment Schedule

This section clearly defines the principal amount borrowed, the interest rate (if applicable), and the repayment schedule.

Image Source: signaturely.com

Repayment Frequency: Specify whether repayments will be made monthly, quarterly, annually, or on a different schedule.

Loan Purpose

The template should clearly state the intended use of the loan funds. This helps ensure that the funds are used for the agreed-upon purpose and reduces the risk for the lender.

Security Interests (if applicable)

If the loan is secured by collateral (such as property or vehicles), this section should clearly outline the collateral, its value, and the lender’s rights to the collateral in case of default.

Default and Remedies

This crucial section defines what constitutes a default on the loan (e.g., missed payments, breach of contract). It also outlines the lender’s remedies in case of default, such as:

Acceleration of the loan: The entire outstanding balance becomes due immediately.

Governing Law and Jurisdiction

This section specifies the governing law of the agreement and the jurisdiction in which any disputes will be resolved.

Entire Agreement

This clause states that the loan agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications or agreements.

Severability

This clause ensures that if any provision of the agreement is deemed invalid or unenforceable, the remaining provisions will remain in full force and effect.

Notices

This section outlines the procedures for providing notices and other communications between the parties.

Signatures

The agreement must include spaces for both the lender and the borrower to sign and date the document.

Design Considerations for a Professional Template

Font and Typography

Clear and Readable: Choose a professional and easy-to-read font such as Arial, Times New Roman, or Calibri.

Layout and Spacing

White Space: Utilize ample white space to improve readability and make the document visually appealing.

Professionalism and Trust

Clean and Concise Language: Use clear, concise, and professional language that is easy to understand.

By carefully considering these elements, you can create a professional and effective Blank Loan Agreement Template that protects both lenders and borrowers.

Disclaimer: This guide provides general information and should not be construed as legal advice. You should consult with an attorney to ensure that your loan agreement complies with all applicable laws and regulations.