A well-crafted long-term loan agreement template is crucial for both lenders and borrowers. It outlines the terms and conditions of the loan, ensuring clarity, mitigating risks, and providing a legal framework for the entire borrowing process. This guide will focus on the key elements and design considerations for creating a professional and effective long-term loan agreement template.

1. Core Agreement Provisions

The foundation of any loan agreement lies in its core provisions. These should be clearly and concisely drafted to avoid ambiguity and potential disputes.

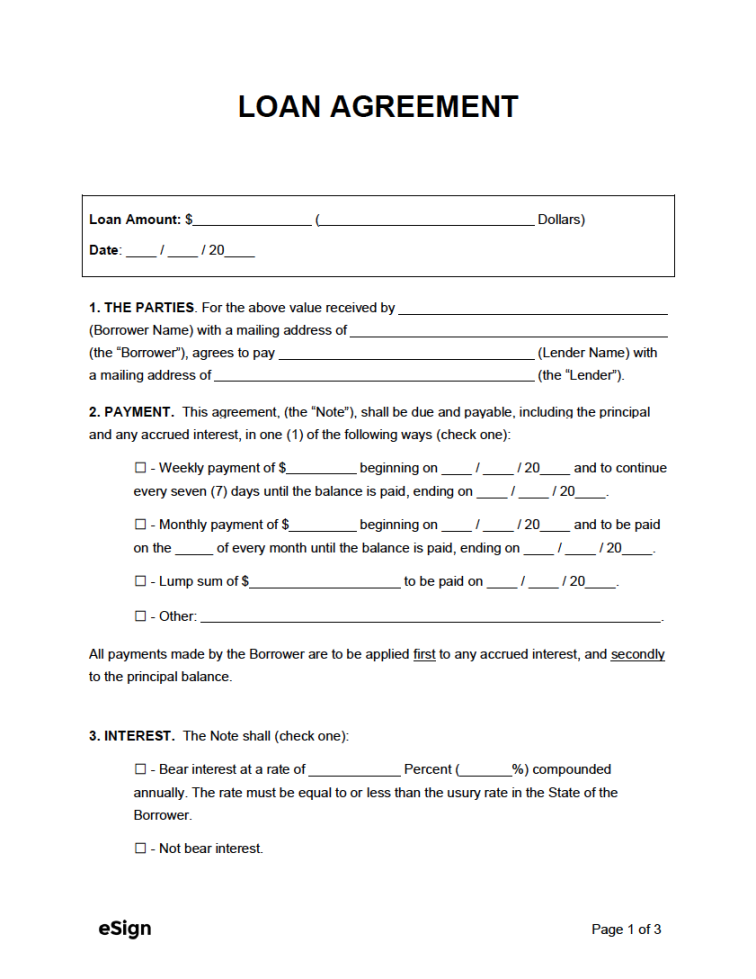

Image Source: esign.com

Loan Amount and Purpose:

The agreement must explicitly state the total loan amount, its currency, and the specific purpose for which the funds are being borrowed. This ensures that the borrower utilizes the funds as intended.

Clearly define the interest rate applicable to the loan. This could be a fixed rate, a variable rate tied to a specific benchmark, or a combination of both. Establish a comprehensive repayment schedule, including the frequency of payments (e.g., monthly, quarterly), due dates, and the total number of payments.

Specify the duration of the loan agreement, including the start date and the maturity date when the loan is expected to be fully repaid.

If the loan is secured by collateral (e.g., property, equipment), the agreement must detail the nature and value of the collateral. It should also outline the lender’s rights and remedies in case of default, such as the right to seize and sell the collateral.

Define events that constitute a default, such as late payments, breach of covenants, or insolvency of the borrower. Outline the consequences of default, including late fees, acceleration of the loan, and legal recourse available to the lender.

Include covenants that the borrower agrees to abide by, such as maintaining certain financial ratios, providing financial statements, and obtaining lender consent for certain actions.

2. Representations and Warranties

Representations and warranties are crucial for both parties to understand the circumstances surrounding the loan.

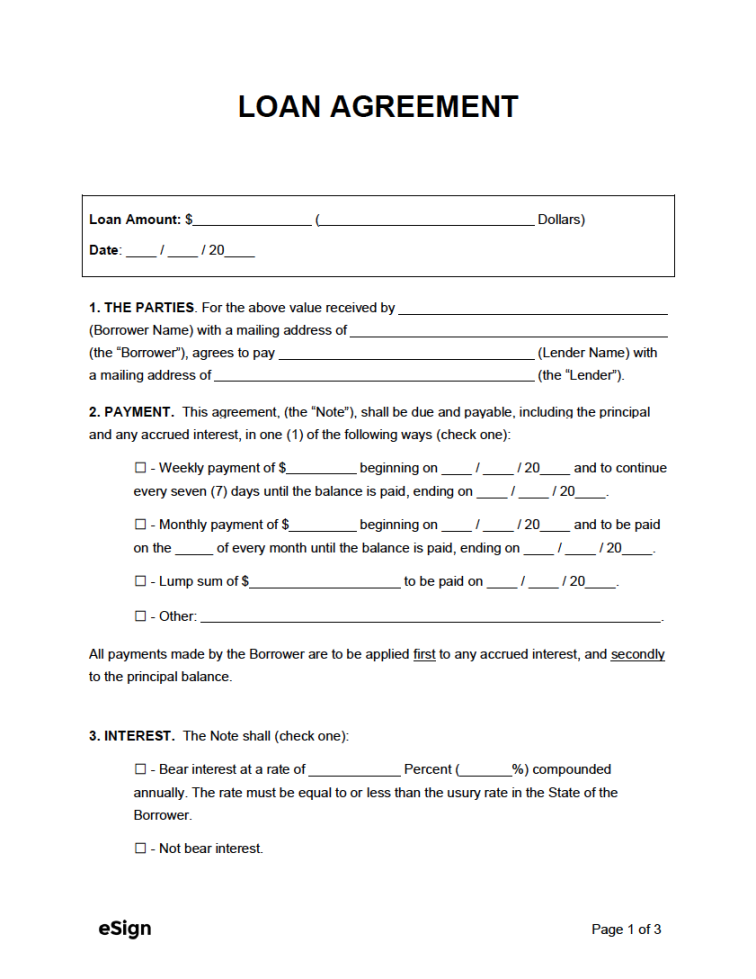

Image Source: esign.com

Borrower’s Representations:

The borrower should make representations regarding its financial condition, legal status, and authority to enter into the loan agreement.

The lender may also make representations regarding its authority to lend and its compliance with relevant laws and regulations.

3. Governing Law and Jurisdiction

Specify the governing law that will apply to the loan agreement and the jurisdiction in which any disputes will be resolved. This ensures clarity and predictability in case of legal action.

4. Notices

Establish clear procedures for delivering notices and other communications between the parties. This may include specifying acceptable methods of delivery (e.g., email, certified mail) and the addresses to which notices should be sent.

5. Entire Agreement

Include an “entire agreement” clause that states that the loan agreement constitutes the entire understanding between the parties with respect to the subject matter of the agreement. This helps to prevent disputes arising from prior or contemporaneous oral or written communications.

6. Design Considerations for Professionalism and Trust

The visual presentation of the loan agreement is equally important as its legal content.

Professional Typography:

Utilize a clean and professional font such as Arial, Times New Roman, or Calibri. Avoid overly decorative or difficult-to-read fonts.

Use plain and straightforward language, avoiding legal jargon whenever possible. Define any technical terms that are used.

Maintain consistent formatting throughout the document, including font size, line spacing, and indentation.

Use clear and concise headings and subheadings to organize the agreement and make it easier to navigate.

Incorporate ample white space to improve readability and make the document less overwhelming.

Use a professional and consistent layout, such as a two-column format, with clear margins and spacing.

Consider including a brief executive summary at the beginning of the agreement to provide an overview of the key terms and conditions.

7. Electronic Signatures

Incorporate provisions for electronic signatures to facilitate efficient execution of the agreement. Ensure compliance with applicable laws and regulations regarding electronic signatures.

8. Regular Review and Updates

It is crucial to review and update the loan agreement template periodically to ensure its accuracy, relevance, and compliance with changing laws and regulations.

By carefully considering these elements and design considerations, you can create a professional and effective long-term loan agreement template that protects the interests of both lenders and borrowers while fostering a strong and trusting relationship.