A Net Present Value (NPV) Excel template is a powerful financial tool used to evaluate the profitability of potential investments. By discounting future cash flows to their present value, the NPV analysis helps determine whether an investment is likely to generate a positive return.

Core Components

The foundation of a professional NPV Excel template lies in its structure and clarity.

Data Input Section

This section should be well-organized and easy to navigate.

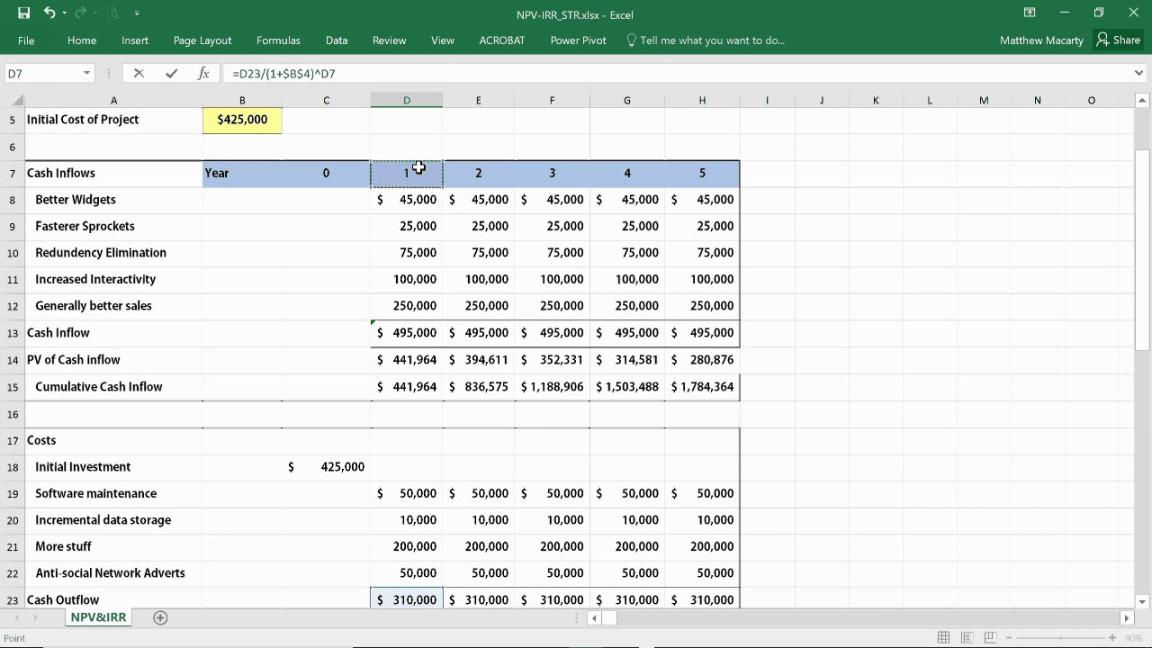

Cash Flow Projections

Image Source: ytimg.com

This section should accurately reflect the expected cash inflows and outflows associated with the investment over its projected lifetime.

NPV Calculation

The core of the template lies in the NPV calculation itself.

Design Considerations

A professional NPV Excel template should not only be functional but also visually appealing and easy to understand.

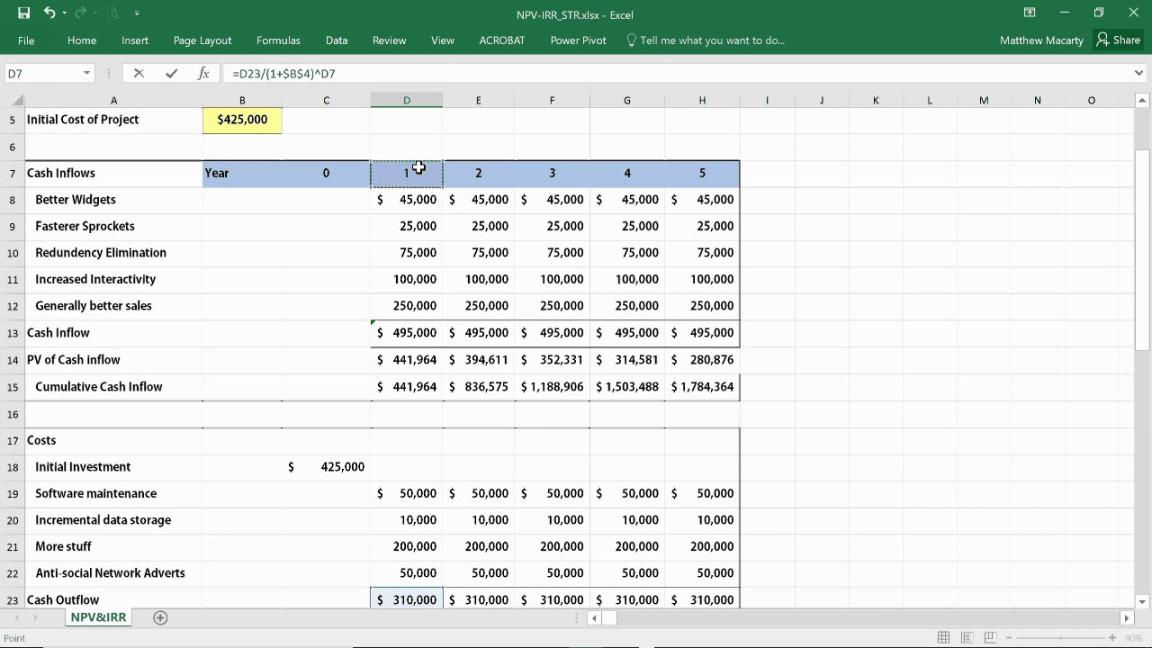

Consistent Formatting

Image Source: ytimg.com

Maintain consistent formatting throughout the template. Use a consistent font, font size, and color scheme.

Clear and Concise Labeling

Use clear and concise labels for all cells, formulas, and sections.

Professional Color Palette

Choose a professional color palette that is both visually appealing and easy on the eyes.

Data Visualization

Incorporate charts and graphs to visually represent key data points and trends.

User Experience

A well-designed NPV Excel template should be user-friendly and intuitive.

User Instructions

Include concise and easy-to-follow user instructions within the template.

Data Validation

Implement data validation rules to ensure that users enter data correctly.

Flexibility and Customization

Design the template to be flexible and adaptable to different investment scenarios.

By adhering to these principles, you can create a professional NPV Excel template that is not only a valuable financial tool but also a testament to your attention to detail and commitment to excellence.

This comprehensive guide provides a framework for developing a high-quality NPV Excel template that is both functional and visually appealing. By carefully considering the core components, design considerations, and user experience, you can create a tool that is both effective and user-friendly.

Remember that a well-designed NPV Excel template can significantly enhance your investment decision-making process by providing a clear and concise framework for evaluating the profitability of potential opportunities.