A private loan agreement template is a crucial document for both lenders and borrowers when engaging in private lending arrangements. This template serves as a legally binding contract that outlines the terms and conditions of the loan, ensuring clarity and minimizing potential disputes.

Crafting a professional and effective private loan agreement template is essential for establishing trust and protecting the interests of all parties involved.

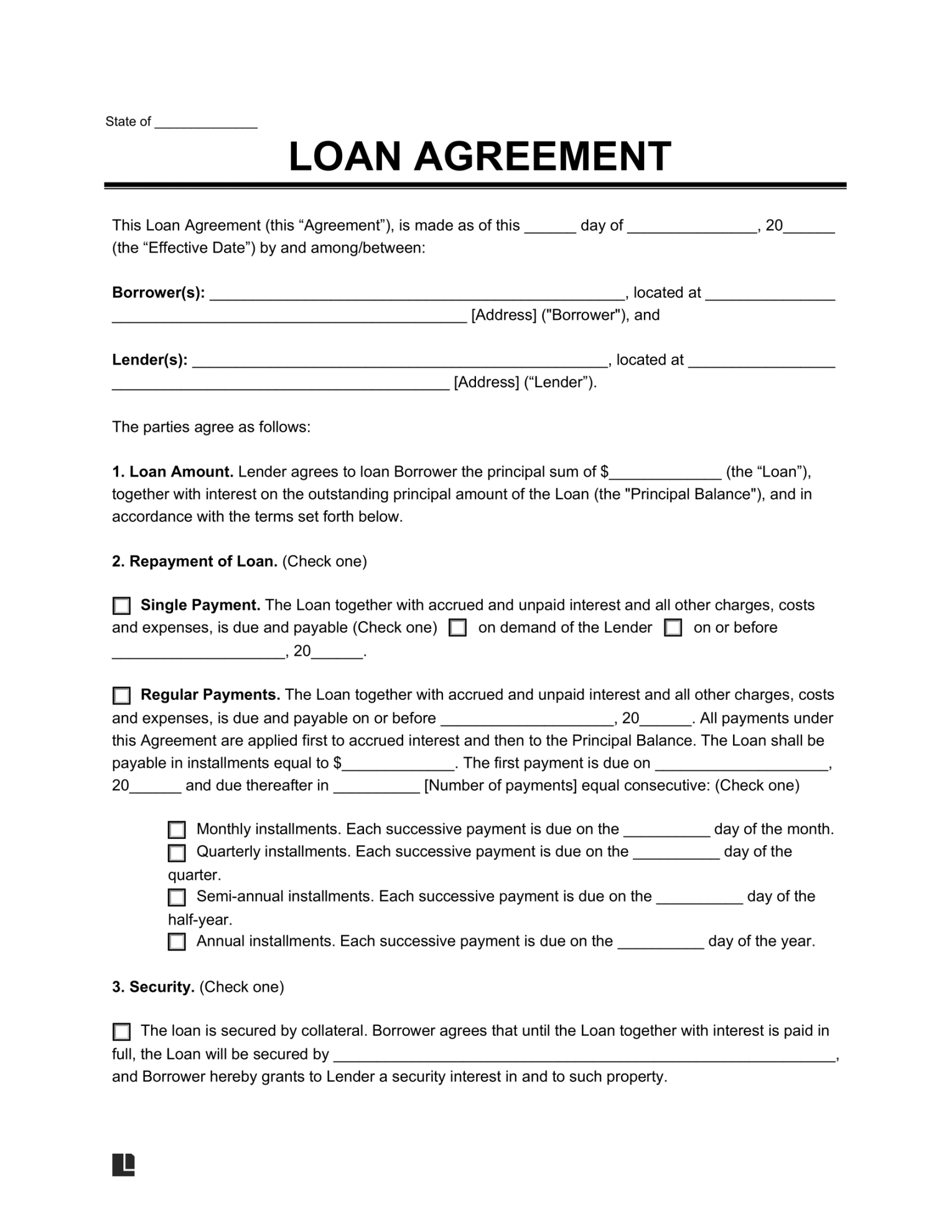

Key Elements of a Comprehensive Private Loan Agreement

![+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab + Simple Loan Agreement Templates [FREE] ᐅ TemplateLab](https://reptilesevolution.com/wp-content/uploads/2024/12/simple-loan-agreement-templates-free-templatelab.jpg)

Image Source: templatelab.com

A well-drafted private loan agreement should encompass the following key elements:

Loan Amount and Purpose

Clearly define the total loan amount, its intended purpose, and any specific restrictions on how the funds can be utilized. This ensures that the borrower uses the loan funds as agreed upon.

Interest Rate and Repayment Schedule

Specify the interest rate applicable to the loan, whether it’s a fixed or variable rate.

Outline the repayment schedule, including the frequency of payments (e.g., monthly, quarterly) and the due dates for each installment.

Repayment Terms

Image Source: legaltemplates.net

Detail the loan’s repayment period, including the start and end dates.

Clearly define any grace periods for the first payment or specific circumstances.

Include provisions for early repayment options and any associated penalties or benefits.

Collateral (if applicable)

If the loan is secured by collateral (e.g., property, vehicles), clearly describe the collateral and its value.

Outline the procedures for securing and releasing the collateral.

Specify the consequences of default, including potential foreclosure or repossession.

Default and Remedies

Define specific events that constitute a default, such as late payments, missed payments, or breach of any other loan terms.

Outline the remedies available to the lender in case of default, such as acceleration of the loan balance, legal action, or repossession of collateral.

Governing Law and Jurisdiction

Specify the governing law that will be applicable to the loan agreement.

Indicate the jurisdiction where any legal disputes arising from the agreement will be resolved.

Dispute Resolution

Outline the preferred method for resolving any disputes that may arise between the lender and the borrower.

Consider options such as mediation, arbitration, or litigation.

Entire Agreement

Include a clause stating that the loan agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications or agreements.

Severability

Include a severability clause that states that if any provision of the agreement is deemed invalid or unenforceable, the remaining provisions shall remain in full force and effect.

Notices

Specify the method for delivering notices and other communications between the lender and the borrower.

This may include email, certified mail, or in-person delivery.

Signatures

Ensure that the agreement contains spaces for both the lender and the borrower to sign and date the document.

Design Considerations for a Professional Template

The visual presentation of the loan agreement is crucial for conveying professionalism and enhancing readability. Consider the following design elements:

Font and Formatting

Use a professional and easy-to-read font such as Arial, Times New Roman, or Calibri.

Maintain consistent font sizes and styles throughout the document.

Utilize headings and subheadings to improve readability and navigation.

Employ bullet points or numbered lists to organize information effectively.

Spacing and Alignment

Use consistent spacing between paragraphs and lines to enhance readability.

Align text to the left for a clean and professional appearance.

Utilize appropriate margins to ensure sufficient space for printing and reading.

Clarity and Conciseness

Use clear, concise, and unambiguous language throughout the agreement.

Avoid legal jargon whenever possible.

Define any technical terms or acronyms used in the document.

Structure sentences and paragraphs logically to facilitate easy comprehension.

Professional Layout

Use a clean and professional layout that is visually appealing and easy to navigate.

Consider using a table of contents for longer agreements.

Incorporate clear headings and subheadings to guide the reader through the document.

Maintain a consistent and professional tone throughout.

By incorporating these key elements and design considerations, you can create a professional and effective private loan agreement template that protects the interests of both lenders and borrowers while fostering a mutually beneficial lending relationship.

Remember that this guide provides a general framework.

It is always advisable to consult with an attorney to ensure that your specific loan agreement complies with all applicable laws and regulations.

This comprehensive guide should provide you with the necessary information to create a professional and effective private loan agreement template.

By utilizing a well-drafted template, you can streamline the loan process, reduce risks, and build stronger relationships with your borrowers.