A well-designed Export invoice Template in QuickBooks is crucial for businesses involved in international trade. It serves as a formal document that details the goods or services exported, their value, and the terms of sale. A professional template ensures accurate and efficient invoicing, smooth customs clearance, and a positive impression on international clients.

Clarity and Conciseness

The template should prioritize clarity and conciseness.

The information presented must be easily understandable to both the exporter and the importer.

Avoid unnecessary jargon or overly complex language.

Use clear and concise headings and subheadings to organize information effectively.

Ensure all relevant details are included in a logical order.

Professional Design

The visual appeal of the invoice is paramount.

A clean and professional design instills confidence in the recipient.

Utilize a consistent font style and size throughout the document.

Consider using a company logo and branding elements to enhance professionalism.

Employ a professional color scheme that is visually appealing and easy to read.

Maintain ample white space to improve readability and prevent the invoice from appearing cluttered.

Essential Information

Image Source: website-files.com

The template must include all essential information required for international trade transactions.

This includes:

Customization

The template should be customizable to suit the specific needs of each export transaction.

Consider including fields for:

Accuracy and Reliability

The template should be designed to minimize errors and ensure accuracy.

Consider using automated features within QuickBooks to populate fields with relevant information.

Implement checks to ensure all required fields are filled in correctly.

Regularly review and update the template to reflect any changes in regulations or business practices.

Data Security

Image Source: website-files.com

The template should incorporate security measures to protect sensitive information.

Consider using encryption to safeguard data during transmission.

Implement access controls to restrict access to the template and invoice data.

Regularly back up the template to prevent data loss.

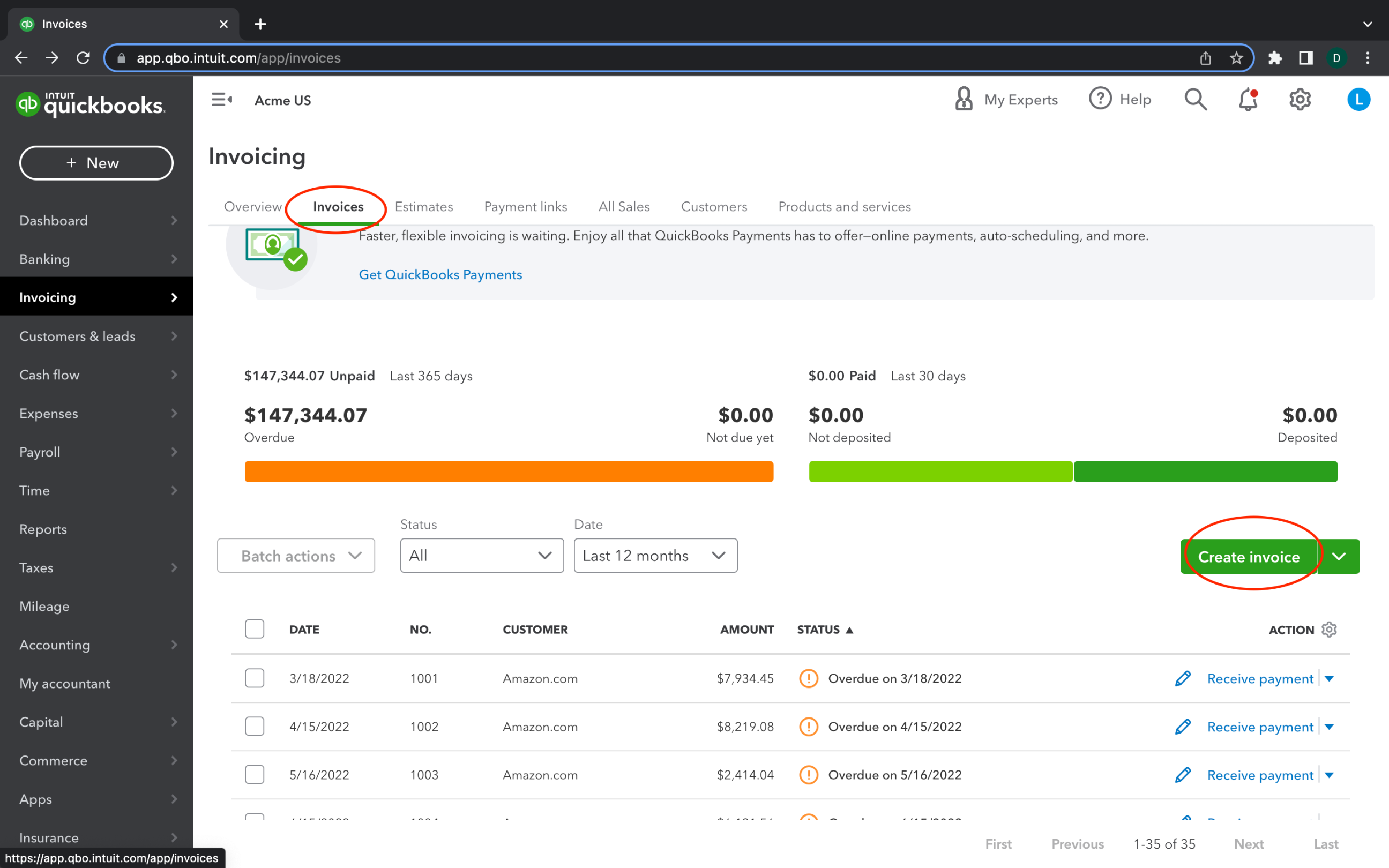

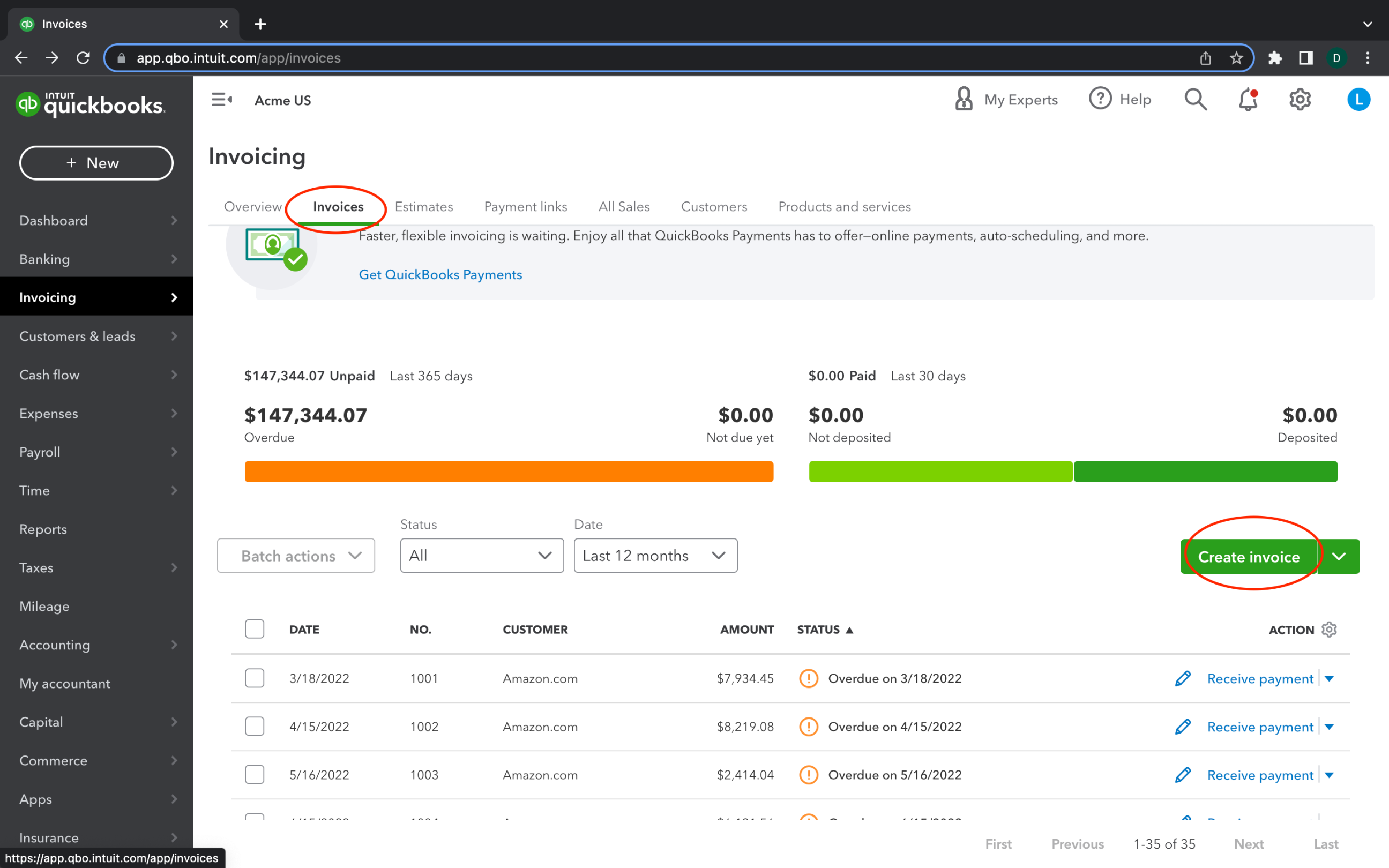

Integration with QuickBooks

The template should seamlessly integrate with other QuickBooks features.

This allows for easy data entry, automated calculations, and streamlined invoicing processes.

Utilize QuickBooks’ reporting features to generate customized reports based on invoice data.

Integrate with other accounting software or e-commerce platforms, if necessary.

Regular Review and Updates

The template should be reviewed and updated regularly to ensure its accuracy and effectiveness.

Stay informed about changes in international trade regulations and best practices.

Gather feedback from clients and employees to identify areas for improvement.

Periodically test the template to ensure it functions correctly and meets the needs of the business.

By adhering to these guidelines, businesses can create professional Export Invoice Templates in QuickBooks that enhance efficiency, accuracy, and compliance with international trade regulations. A well-designed template contributes to a positive customer experience and strengthens relationships with international clients.